Treasury stock is stock that the issuing corporation repurchases from shareholders. The repurchased shares are not recorded as an asset on the company’s balance sheet; instead, the company records treasury stock as a reduction to shareholders’ equity.

Example of Treasury Stock Purchase

Company A’s corporate charter authorized 10,000,000 shares of common stock at a par value of $0.0001 per share. As part of its initial public offering (IPO), the company issued 10,000,000 shares of common stock at $6.50 per share for total proceeds raised of $65,000,000. Following the transaction, the company’s balance sheet reflects the following equity numbers:

- Common Stock at Par: $1,000 (10,000,000 times $0.0001)

- APIC: $64,999,000 ($65,000,000 minus $1,000)

On June 30, 2023, the company repurchased some of its outstanding shares. The company purchased 250,000 shares at $10 per share for a total purchase price of $2,500,000. The corporation can account for the transaction using either the cost method or par value method.

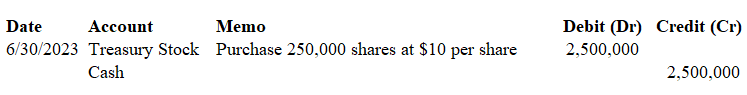

Cost Method Entry

The cost method is more common. Under the cost method, the corporation records the total purchase amount as treasury stock.

The corporation makes the following entry:

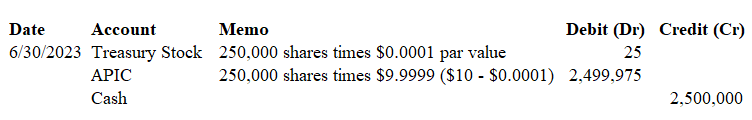

Par Value Method Entry

Under the par value method, the corporation separates the share repurchase between treasury stock and additional paid in capital (APIC). To the extent APIC is reduced to zero, the excess would be a reduction to retained earnings.

The corporation makes the following entry:

After the journal entry, the corporation’s equity section reflects the following:

- Common Stock at Par: $1,000 (10,000,000 times $0.0001)

- APIC: $62,499,025 ($65,000,000 minus $2,499,975)

- Treasury Stock: $25