A company’s Operating Profit Margin (OPM) is a profitability ratio that measures its net operating profit against its total revenues. The operating profit margin is also referred to as the EBIT Margin.

The company’s Earnings Before Interest & Taxes (EBIT) is also called its operating profit. A company calculates its operating profit margin using the following formula:

OPM = Operating Profit / Total Revenue

A company calculates its operating profit by subtracting all operating expenses, cost of goods sold (COGS), depreciation, and amortization expenses. Items not deducted include income taxes and interest.

Example Calculation

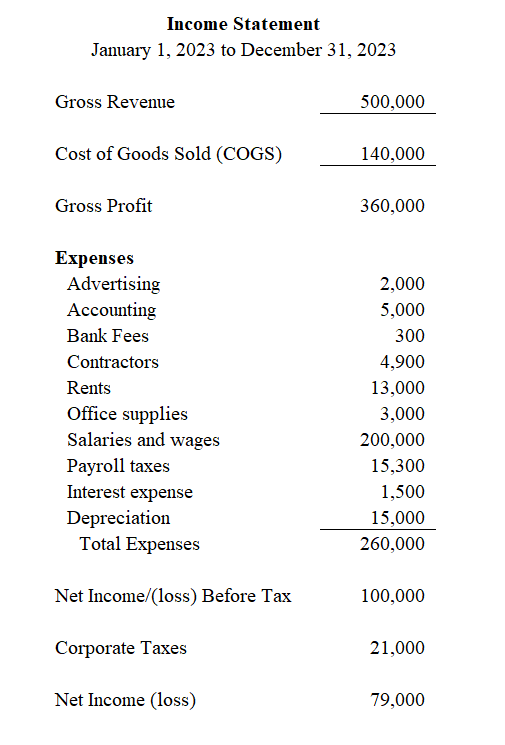

Company A’s income statement shows the following revenue and expenses for the 2023 fiscal year. The company wants to calculate its operating profit margin ratio for the 2023 fiscal year.

The company calculates its operating profit margin as follows:

EBIT = Net Income + Income Taxes + Interest Expense

EBIT = $79,000 + $21,000 + $1,500

EBIT = $101,500

OPM = $101,500 / $500,000

OPM = 0.203

The company’s operating profit margin ratio is 20.30%