A partnership liability is a nonrecourse debt if no partner, or person related to a partner, bears the economic risk of loss for that liability.1 In other words, the partnership debt can only be paid using profits generated from the business. To the extent the partnership is unable to pay the debt, no partner is personally liable to pay the debt, nor are any of the partners required to contribute additional capital to the partnership to pay the debt.

In contrast, when a partnership has recourse debts, the partners are personally liable for repaying the liabilities to the extent the partnership is unable to pay those debts from its business profits.

Types of Nonrecourse Liabilities

Nonrecourse liabilities generally arise with unsecured debts with no collateral. However, nonrecourse liabilities also include secured debt collateralized by property where the note agreement is a nonrecourse note.

For example, assume a partnership LLC purchases a truck and signs a nonrecourse note with the lender. The collateral attached to the note is the vehicle. If the partnership defaults on the note, the lender can repossess the vehicle; however, it cannot collect any additional balance owed by the partners because the lender agreed to a nonrecourse note.

IRS Form 1065 Reporting

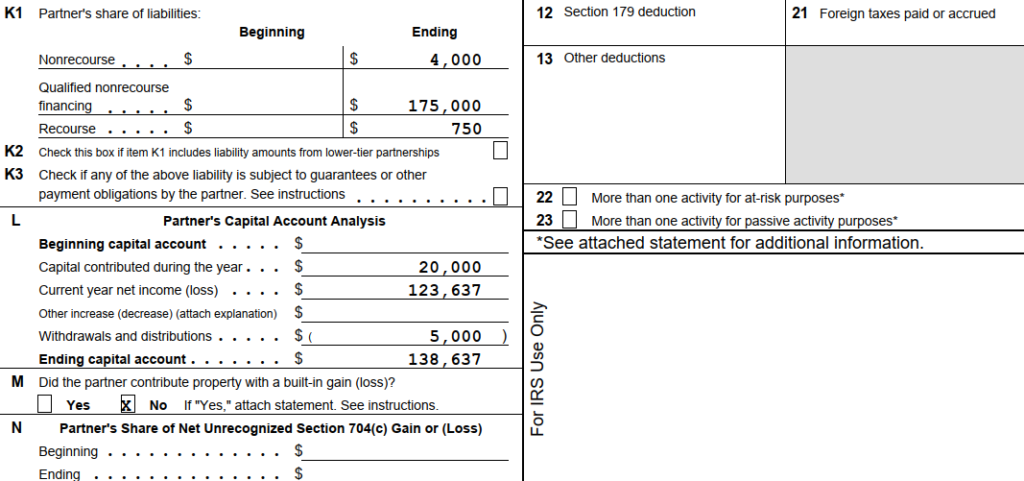

A partnership is required to separately state its nonrecourse liabilities, recourse liabilities, and qualified nonrecourse financing on Schedule K-1 (Form 1065). Each partner uses this information to calculate their basis under Section 704(d) and their at-risk basis limitations under Section 465.

The sample Schedule K-1 below shows the various allocations for this particular partner in Item K1 (Partner’s Share of Liabilities).

Other Information

Taxpayers can find more information on partnership liabilities and tax rules in IRS Publication 541 (Partnerships).