A company’s interest coverage ratio (ICR) measures how well it can pay the interest expense on its outstanding liabilities. The ratio measures a company’s Earnings Before Interest & Taxes (EBIT) against its total interest expense for the period. Alternatively, the company can use Earnings Before Interest, Taxes, Depreciation & Amortization (EBITDA) against its interest expense.

The formula for the interest coverage ratio using EBIT:

ICR = EBIT / Interest Expense

The formula for the interest coverage ratio using EBITDA:

ICR = EBITDA / Interest Expense

The EBITDA amount excludes noncash expenses like depreciation and amortization, which is a better measure of a company’s ability to pay interest expenses.

Example ICR Calculation

Company A wants to calculate its interest coverage ratio for the 2023 fiscal year.

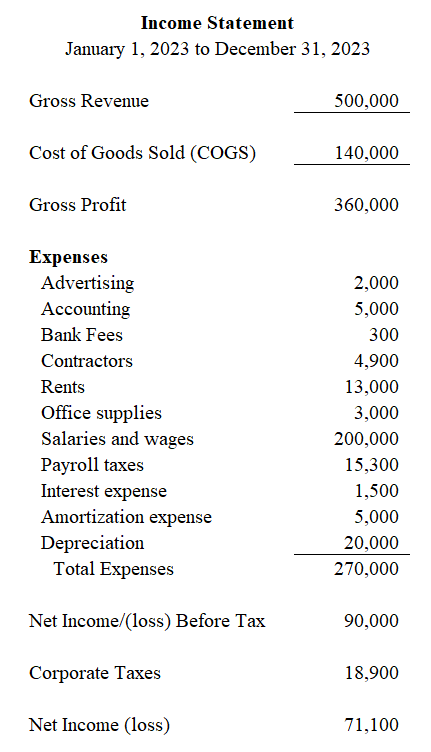

The Company’s income statement for the year is the following:

Company A calculates its ICR using EBIT as follows:

EBIT = $71,100 + $18,900 + $1,500

EBIT = $91,500

ICR = $91,500 / $1,500

ICR = 61

Company A can pay its interest payments 61 times using EBIT. Given the high ICR, the Company can easily pay its interest on open debts.

Company A calculates its ICR using EBITDA as follows:

EBITDA = $71,100 + $18,900 + $20,000 + $5,000 + $1,500

EBITDA = $116,500

ICR = $116,500 / $1,500

ICR = 77.67

Company A can pay its interest payments 77 times using EBITDA.