A company’s Income Statement is a financial statement that reports the company’s revenues, expenses, and net income over a defined period. A company will also use a Balance Sheet and Statement of Cash Flows to measure its financial performance.

The income statement may also be called the Statement of Operations or Statement of Profit or Loss.

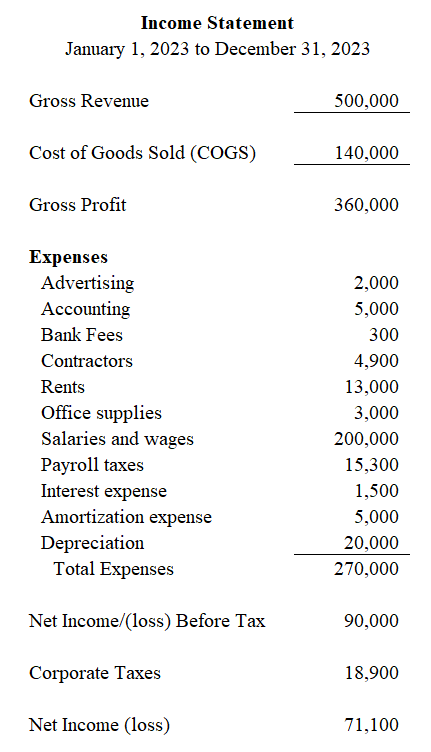

The company’s revenues and other income from operations are reported first on the income statement. If applicable, a company reports the cost of goods sold (COGS) below its total revenues. The company deducts COGS from total revenues to determine its gross profit and calculate its Gross Profit Margin.

The company deducts operating expenses from its gross profit to arrive at income/(loss) from operations. Next, if the company is directly subject to corporate income taxes, it subtracts those taxes to arrive at net income/(loss).

If a company has other unusual items of income or loss, those are generally reported below the net income/(loss) as other comprehensive income/(loss). A sample income statement for a corporation is below: