A homestead is an owner-occupied property where the owner primarily resides and uses it as their principal residence.

The primary advantages to property classified as your homestead are asset protection and tax benefits. What constitutes a homestead will vary by state, and each state has different rules regarding certain asset protection benefits and tax exemptions.

Asset Protection Benefits

Many states provide asset protection for a person’s homestead property. Under the state constitution and related statutes, homestead property is generally shielded from creditors.

If an individual has a judgment recorded against them, the creditors cannot attach to or become a lien on the homestead property, effectively preventing a homeowner from having their house seized and made homeless because of a judgment.

However, there are certain exceptions. Under Florida law, for example, some exceptions include mechanics liens or tax liens related to unpaid federal, state, or local taxes.

Property Tax Benefits

Many states will offer a homestead exemption on their property tax bills. For example, in the state of Florida, a person can apply for homestead and receive a $50,000 reduction in the assessed value for property tax purposes.

The first $25,000 applies to all property taxes, and the added $25,000 exemption applies to taxes that are non-school taxes.

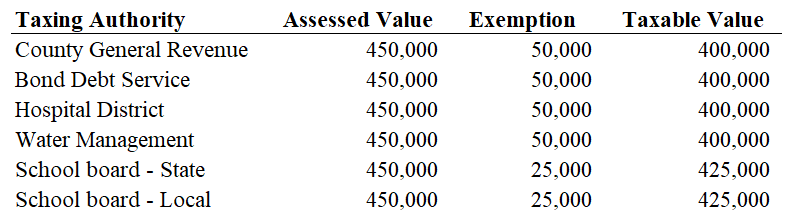

For example, if John Doe has a single-family home which is his homestead in Sarasota, FL, John can apply for the homestead tax exemption. The assessed value of the property for property tax purposes is $450,000. John can use the $25,000 exemption to reduce the assessed taxable value to $425,000 across all property tax categories.

The additional $25,000 can be claimed on any taxes except school related taxes. John’s property tax bill may look like the below table. Notice how only a $25,000 exemption applies to state and local school tax, while the full $50,000 is available for non-school related taxes. The Ad valorem tax is then assessed against the taxable value of the property.

Homestead Application in Florida

A Florida homeowner can apply for homestead by submitting Florida Form DR-501 (Original Application for Homestead and Related Tax Exemptions) which can be found on the Florida Department of Revenue website.

More information on the Florida Property Tax Exemption for Homestead Property is available in this Florida DOR Brochure.