EBITDA measures a company’s profits after accounting for its cost of goods sold (COGS) and operating expenses.

The EBITDA calculation excludes interest, taxes, depreciation, and amortization expense. The calculation excludes these factors because the amount of debt service, income tax, depreciation, and amortization will vary significantly between companies. The EBITDA computation removes these items to better measure a company’s core business operating results against its competitors.

A similar financial calculation is Earnings Before Interest & Taxes (EBIT), which calculates a company’s operating profit without accounting for interest and income taxes, but it does include deductions for depreciation and amortization expense.

The EBITDA calculation is the following:

EBITDA = Gross Revenue – COGS – Operating Expenses (exclude depreciation, amortization & interest)

A company can also calculate its EBITDA by taking its after-tax net income and adding back income taxes, interest, depreciation, and amortization expenses.

Example EBITDA Calculation

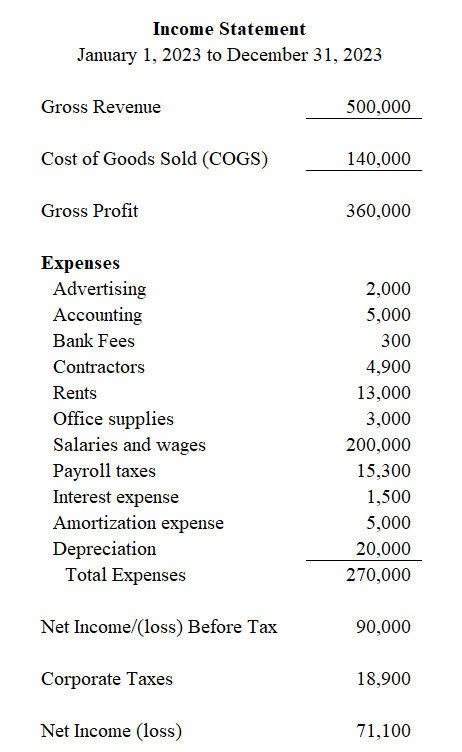

Company A’s income statement shows the following revenue and expenses for the 2023 fiscal year.

The company calculates its EBITDA as follows:

First, the company adds up all of its operating expenses, excluding the interest, depreciation, amortization, and corporate income taxes.

Operating Expenses = (2,000 + 5,000 + 300 + 4,900 + 13,000 + 3,000 + 200,000 + 15,300)

Operating Expenses = $243,500

EBITDA = $500,000 – $140,000 – $243,500

EBITDA = $116,500

The Company’s EBITDA for 2023 is $116,500.

Alternative EBITDA Formula

Company A could take its net income and add back its income taxes, interest, depreciation & amortization.

EBITDA = NI + Income Taxes + Interest + Depreciation + Amortization

EBITDA = $71,100 + $18,900 + $20,000 + $5,000 + $1,500

EBITDA = $116,500