The IRS CP 575 Letter is a confirmation letter sent by the IRS to the applicant when a new employer identification number (EIN) is assigned. The IRS assigns EINs to legal entities, trusts, estates, non-profit organizations, and sole proprietorships.

If the EIN application was completed online through the IRS website, the CP 575 letter is available immediately for download.

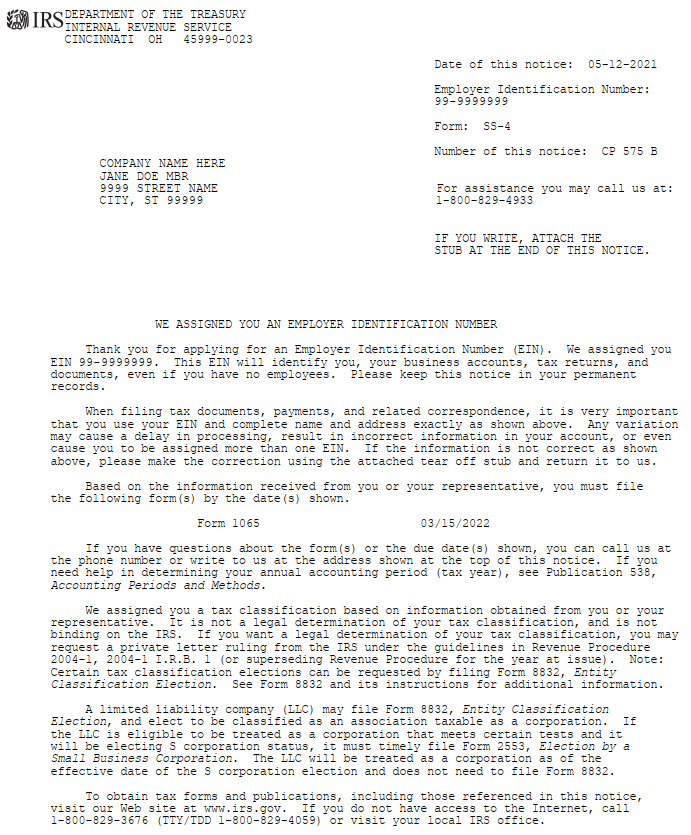

If the applicant used Form SS-4 (Application for EIN) to apply via fax, mail, or phone, a CP 575 letter is mailed to the mailing address listed on Form SS-4. The notice may also include information on the federal tax classification, required federal tax filings, and possible entity classification elections.

The sample CP 575 below is for a multi-member limited liability company (LLC) taxable as a partnership under the default rules.

Sample IRS CP 575 Letter for a Multi-Member LLC

The letter includes a paragraph explaining how the entity may be eligible to file Form 8832 (Entity Classification Election) to elect to be taxed as a corporation or Form 2553 (Election by Small Business Corporation) to elect to be taxed as an S corporation.

Other Information & EIN Applications

More information on CP 575 letters and EIN applications are on the IRS website.