Capital contributions represent the money, or the fair market value of property, contributed to a limited liability company (LLC) in exchange for a membership interest. Capital contributions also apply to forming a partnership, general partnership, or limited partnership (LP).

A corporation’s capital contributions represent a combination of common stock and additional paid in capital (APIC).

Example Capital Contribution for an LLC

Let’s say John and Jane decide to form an LLC in Delaware. They agree that each will own 50% of the LLC membership units. According to the LLC operating agreement, the LLC can issue 100 Class A membership units for $1 per unit.

The LLC issues 50 LLC units to John for $1 each. John deposits $50 of cash into the LLC company bank account, making John’s capital contribution $50 in cash.

The LLC issues 50 LLC units to Jane for $1 each. Jane deposits $50 of cash into the LLC company bank account, making Jane’s capital contribution $50 in cash.

Immediately after the capital contribution, the LLC balance sheet shows assets of $100 in cash and equity of $100 for capital contributions from members.

U.S. Federal Tax Consequences of Capital Contributions

In general, the contribution of property to a partnership does not result in any gain or loss recognition, and the partnership does not recognize the amounts as gross income.1 In the case of a corporation, the corporation does not include the contribution of capital in its gross income.2

Capital Contribution Reporting on Form 1065 & Schedule K-1

For U.S. federal income tax purposes, an entity taxable as a partnership must file an annual Form 1065 (US Return of Partnership Income) to report the partnership’s income, expenses, credits, capital contributions, capital distributions, and other tax items. The partnership tax return includes a Schedule K-1 (Form 1065) for each equity partner, showing each partner’s allocation of the partnership items.

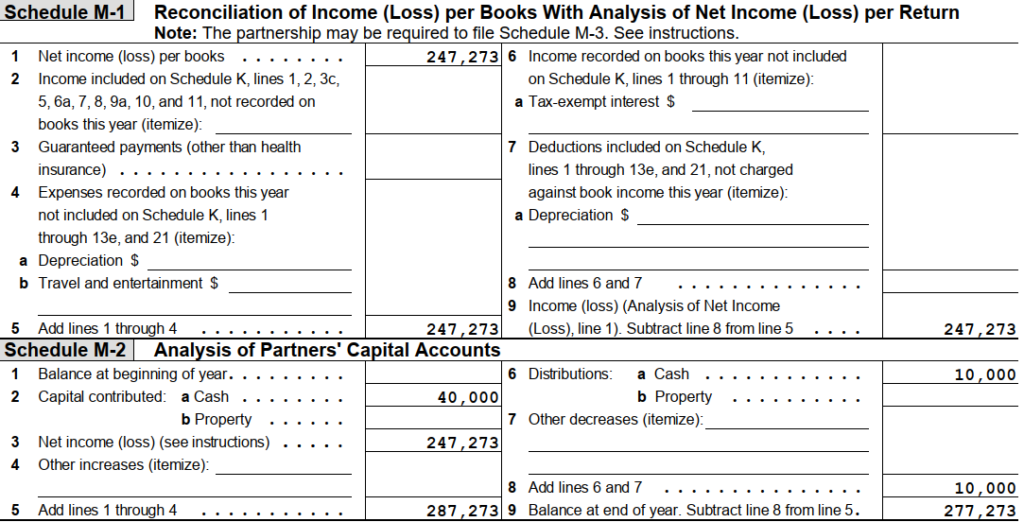

The partnership reports capital contributions and distributions in Schedule M-2 (Analysis of Partners’ Capital Accounts). The partnership reports cash contributions on Line 2(a) and noncash contributions on Line 2(b).

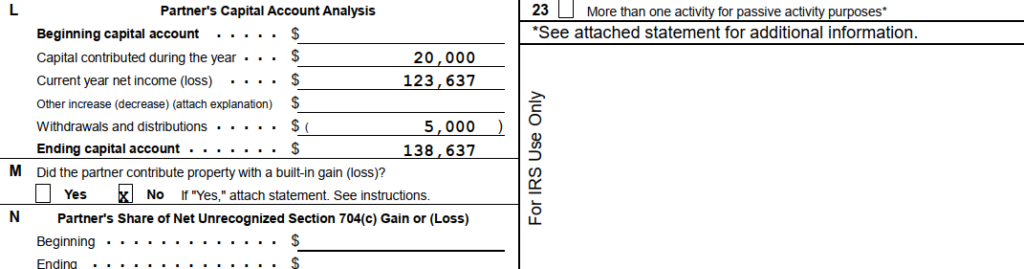

The Schedule K-1 reports capital contributions and distributions in Item L (Partner’s Capital Account Analysis) on separate lines.

More Information on Partnership Taxation

Taxpayers can find more information on the taxation of partnerships by visiting the IRS website and view IRS Publication 541 (Partnerships).