Individual Taxes

Get Ready for U.S. Tax Season

Form 1040 Individual Income Tax Return

Form 1040 is the standard federal income tax form used by U.S. taxpayers to report their gross income, deductions, credits, and tax payments.

Taxpayers are encouraged to file their tax returns electronically using IRS-approved tax preparation software; however, they can also hire a professional tax preparer to file on their behalf.

Our collection of blog posts and video tutorials cover a variety of Form 1040 tutorials as well as the many other schedules and forms that must be included with the tax filing.

View more articles here on Form 1040 tax return tutorials

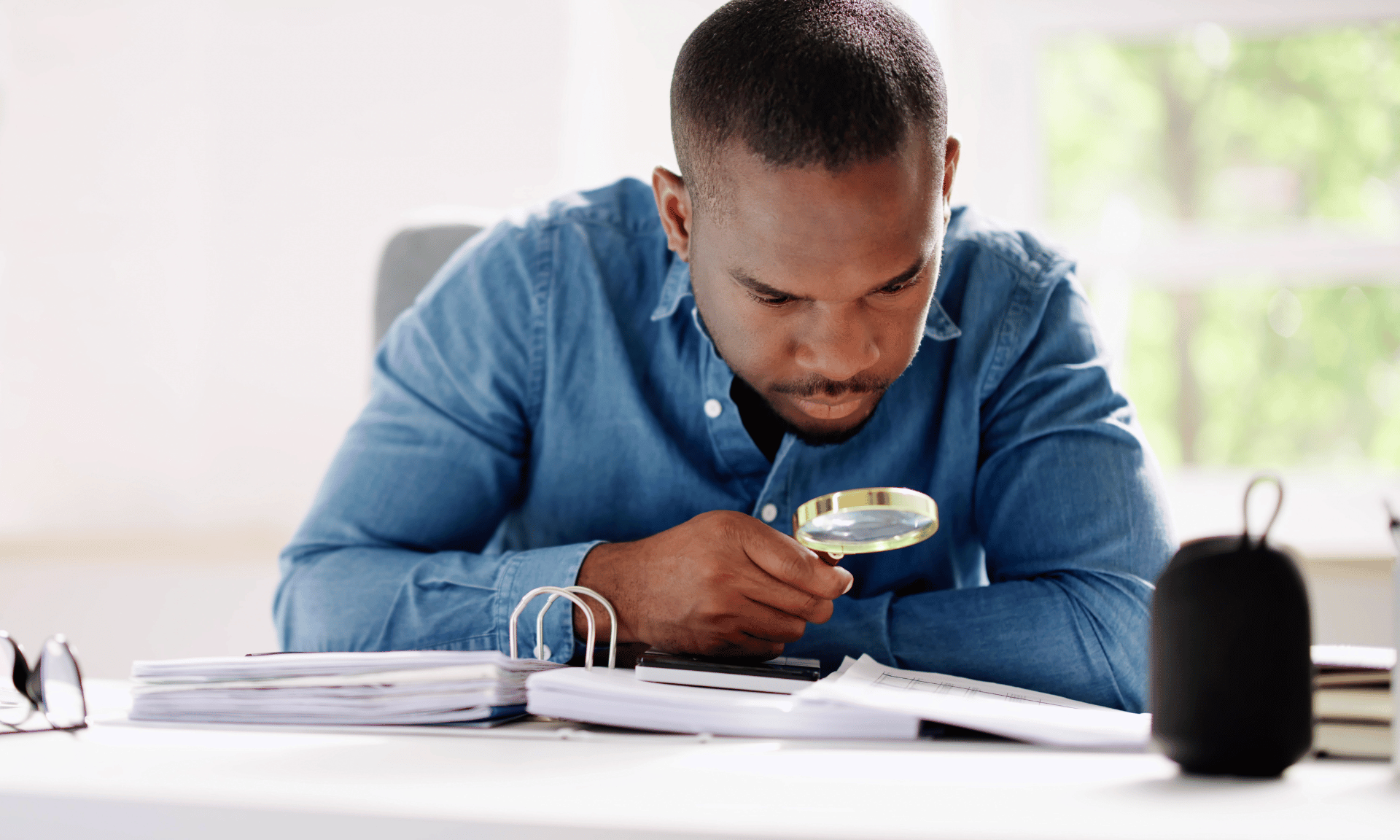

Should You File Your Own Taxes or Hire a Professional?

When it comes to filing your taxes, you have two main options: preparing the return yourself or hiring a tax professional. Each option has its pros and cons.

Self-Prepared Tax Returns:

- Pros: Saves Money. Taxpayers will generally save money by preparing their tax returns. Individuals can purchase tax preparation software for between $0 and $100. On average, hiring a tax professional will cost at least $175 for a basic Form 1040.

- Cons: Time-consuming and Potential Errors. Preparing a tax return can take a lot of time for taxpayers with complicated returns. Federal income tax rules are quite complex, and inexperienced individuals could make mistakes on their tax returns.

Tax Return Preparer:

- Pros: Expertise and Experience. Full-time tax preparers have specific education, training, credentials, and experience that qualify them to prepare tax returns on behalf of other individuals. These individuals may include a tax attorney, certified public accountant (CPA), and enrolled agent (EA).

- Cons: Costly Paid Preparer Fees. Professional tax return preparer fees can vary greatly. Larger firms with more experienced professionals generally charge higher rates. Before an individual hires a return preparer, they should shop the marketplace to find someone who can satisfy their tax needs and is within budget.

Standard Deduction or Itemized Deductions

Generally, each taxpayer can claim either the standard deduction or itemized deductions. The standard deduction amount varies by tax filing status and is adjusted each tax year for inflation.

Claiming itemized deductions using Schedule A (Form 1040) is usually preferred when the total itemized deductions exceed the available standard deduction. Itemized deductions include expenses like home mortgage interest, property taxes, medical expenses, and charitable contributions.

View our collection of posts to learn more about itemized deductions.

View more articles on the standard deduction and itemized tax deductions.

Federal Tax Credits

Tax credits can significantly reduce your tax liability. Unlike deductions, which reduce taxable income, credits reduce the actual tax owed. Federal tax credits can be either refundable or nonrefundable.

Earned Income Tax Credit

The earned income tax credit (EITC) is a refundable tax credit that helps low to medium-income taxpayers reduce their federal and state tax liability. The federal tax credit is the most popular, but many states have their version of the earned income credit.

View more articles on the earned income tax credits.

Child Tax Credits

The Child Tax Credit (CTC) is a tax benefit granted to individuals and families for each qualifying dependent child. The yearly credit amount is generally a maximum of $2,000 per qualifying child.

The CTC is generally a nonrefundable tax credit; however, some taxpayers may be eligible for the Additional Child Tax Credit (ACTC), which is the refundable portion of the CTC. Some taxpayers may have to reduce their credit if their income exceeds certain thresholds.

View our collection of posts and video tutorials on the child tax credit.

View more articles on the child tax credit.

Energy Efficient Property Improvements Tax Credits

Taxpayers who make eligible improvements to their residential property may be entitled to a federal tax credit. The federal government uses these tax credits to incentivize homeowners to make energy-efficient improvements that save resources and improve the environment.

Clean Vehicle Tax Credits

Taxpayers who purchase an electric vehicle for personal or business use may be entitled to a federal or state tax credit. View our articles on clean vehicle tax credits for EVs.

Education Tax Credits

An education tax credit helps supplement the cost of higher education by reducing an individual’s federal income tax liability. There are two types of higher education tax credits:

- American Opportunity Tax Credit (AOTC)

- Lifetime Learning Credit (LLC)

Each credit has different rules for which students qualify and how much their credit amount is for a given tax year.

View our collection of posts and video tutorials on the federal education tax credits.

View more articles on education tax credits.

Retirement Plan Contributions and Taxes

Contributions to retirement plans can offer substantial benefits to taxpayers. The most popular tax-advantaged retirement accounts include the following:

- Traditional IRA: Contributions may be tax-deductible, and earnings grow tax-deferred until withdrawn once the account holder reaches retirement age. Deductibility is limited depending on the taxpayer’s age and whether they are covered by an employer-sponsored retirement plan.

- Roth IRA: Contributions are made with after-tax dollars, so the account holder does not receive a tax deduction for contributions. The account’s investment earnings grow tax-free, and withdrawals are excluded from taxable income.

- 401(k) Plans: Retirement plans sponsored by an employer with employee participation. Employees make contributions using pre-tax dollars, reducing their gross federal taxable income. An employer will typically match a contribution percentage. When a retiree withdraws cash from the 401(k), the individual includes those amounts in taxable income.

View more articles on contributions to retirement accounts.

Tax Filing Deadlines

Make sure to file your Form 1040 or Form 1040-NR by the statutory deadline. If an individual needs more time to file, extensions are available. Here are the key filing deadlines:

- April 15: The statutory deadline is generally 3 and 1/2 months following the close of the tax year, which is usually April 15. For example, if a taxpayer needs to file their Form 1040 for the 2023 tax year, the filing deadline is April 15, 2024. If the April 15 due date falls on a federal holiday or a weekend, the filing deadline moves to the next business day.

- October 15: An individual can file Form 4868 (Extension of Time to File U.S. Tax Return) to extend the filing deadline by 6 months. With an original deadline of April 15, the extended deadline becomes October 15.

- U.S. Expat Tax Return. If a U.S. citizen lives outside the U.S., they are automatically granted an additional two months to file their tax return, which makes the deadline June 15. If more time is required, they can file Form 4868 to extend the deadline to October 15.

- Form 1040-NR Nonresident Return. The Form 1040-NR filing deadlines are the same as the Form 1040 deadline.

Mark these dates on your calendar to ensure timely compliance and avoid late filing penalties and interest.

Health Care and Medical Expenses

Many costs related to health insurance, medical care, prescription drugs, and other expenses can provide certain tax benefits for U.S. taxpayers.

Insurance Premium Tax Credit

If an individual or family enrolls in health insurance coverage through the HealthInsurance.gov marketplace, they may receive a federal tax credit to help pay for their monthly insurance premiums. At the end of the tax year, the taxpayer must include a Form 8962 (Premium Tax Credit) to reconcile their advance premium tax credits.

Self-Employed Health Insurance Deduction

An employee of a company will typically have their health insurance premiums paid for by the company. However, a self-employed (SE) person must pay for their health insurance premiums and may be entitled to a tax deduction.

Health Savings Account (HSA)

An HSA is a tax-favored savings account used to pay for unreimbursed medical expenses for U.S. taxpayers. Cash contributions to an HSA may also help lower your federal taxable income.

Withdrawals from an HSA can be made tax-free when used to pay for qualified medical expenses.

View our collection of blog posts and videos for more guidance on Health Savings Accounts.