One significant factor people consider when choosing a credit card is the annual fee. The vast majority of credit cards charge no annual fees for using the card, so the credit card company makes money on the cardholder by charging interest expense on any unpaid balance carried forward to the next billing cycle. A credit card with no annual fee is generally the go-to choice for most credit card users.

What about credit cards that charge annual fees, some of which are hundreds of dollars per year? These cards often come with more robust rewards programs and benefits, but the real question is, are the fees worth it?

The Perks of High Annual Fee Credit Cards

Credit cards with high annual fees often offer more substantial rewards and perks that can provide tremendous value for the right person. Here are some of the most common benefits:

Generous Rewards Programs and Travel Perks

High annual fee cards typically have higher rewards rates on specific categories, such as travel, dining, or entertainment. These cards can offer 2 to 5 times the points on spending in these categories compared to the no-fee cards that may only offer 1 point per dollar spent.

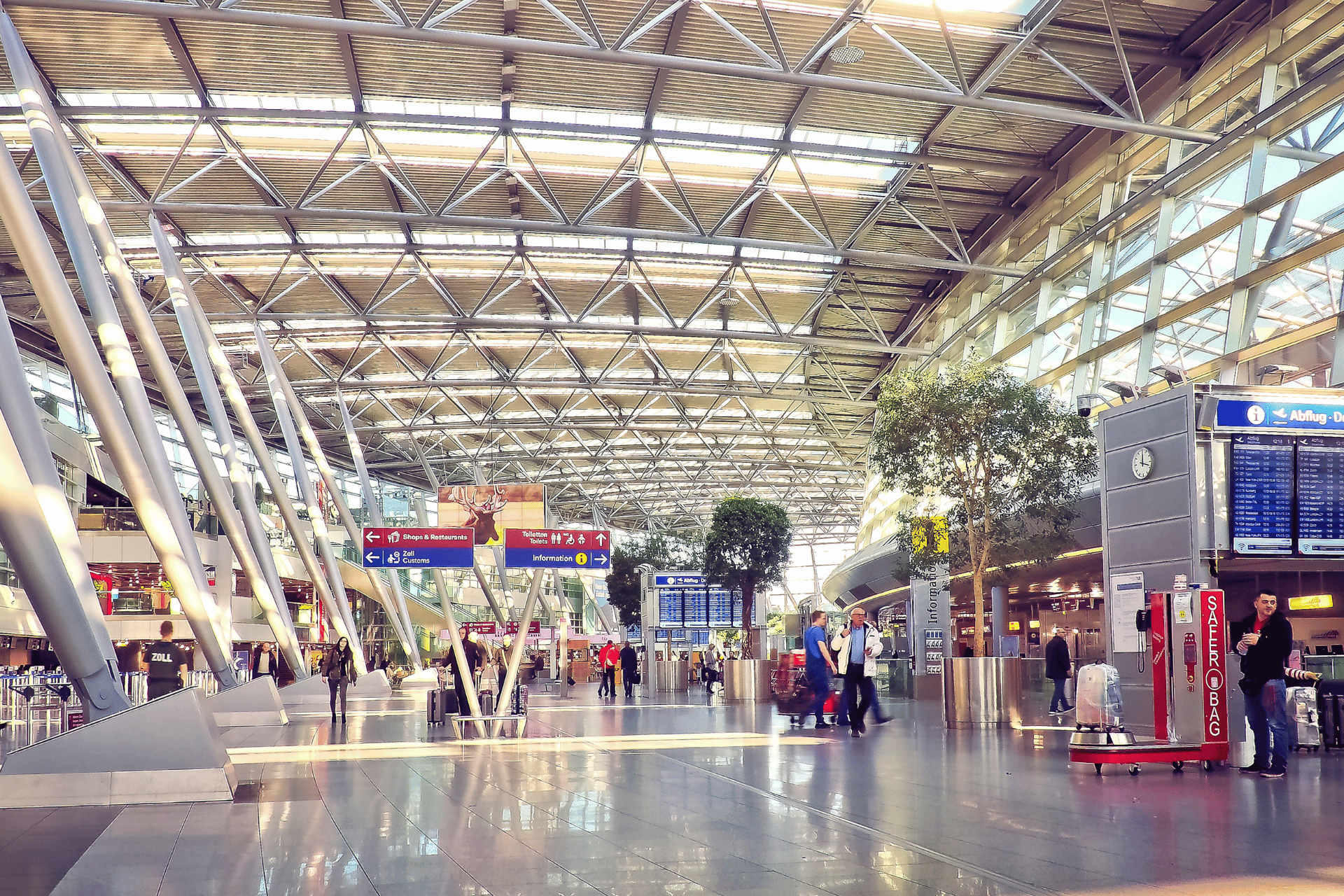

If you spend a lot of time and money on traveling, a premium travel card may offer you a far greater value in terms of points or miles, which could offset the cost of the fee through free flights, hotel stays, or other perks.

For example, the American Express Platinum Card is one of the most popular choices for individuals who travel frequently. The annual membership fee is $695 (as of 2024), which can be quite expensive for many users; however, the card does come packed with a substantial amount of perks. As of 2024, some of the most noteworthy benefits include the following:

- $200 airline fee credit for incidental fees, such as checked bag fees

- $200 hotel fee credit for hotel reservations

- Statement credit for enrolling in CLEAR Plus Membership

- Statement credit for Global Entry or TSA PreCheck membership

- 2x membership points for eligible travel expenses

- 5x membership points for qualified airline tickets and hotel reservations

- Airport lounge access through PriorityPass

- Car rental perks and discounts for many of the major car rental companies, including Hertz, Avis, and National

- Access to Delta Sky Club at participating airports

Sign-Up Bonuses

Many credit cards with high annual fees come with larger sign-up bonuses, such as offering 100,000 bonus points for meeting a spending threshold within the first few months.

For example, a credit card offer may provide that after you open the account, if you spend at least $8,000 within the first six months of using the card, you will receive an additional 125,000 points added to your account. Depending on how you redeem those points, they could be worth several hundred to over a thousand dollars.

Luxury Benefits

Beyond travel, high-fee credit cards may offer perks like concierge services and exclusive event access. These features are designed for individuals looking for a more premium experience. The concierge services may include booking restaurant reservations, exclusive events, or golf tee times.

When Does a No-Fee Card Make More Sense

While high annual fee cards may provide more rewards, they’re not always the right choice for everyone.

If you don’t travel often or need premium services like lounge access at airports, the benefits of a high-fee card may go largely unused. It isn’t easy to justify spending hundreds of dollars on credit card perks you’ll never use.

If your credit card spending is relatively low, it’s possible that the extra rewards points or miles earned from a high-fee card won’t offset the annual fee. A no-fee card, or one with a lower fee, may offer adequate rewards without the extra cost.

What’s the Verdict?

Ultimately, the value of a high annual fee credit card depends on your personal spending habits, career, lifestyle, and how much you value premium perks. If you’re a frequent traveler, either for work or personal reasons, or a big spender in bonus categories, the rewards and travel benefits offered by certain credit cards may justify their high annual fees.

However, for the average consumer who doesn’t need these benefits, a no-fee card might offer more value.