A qualified electing fund (QEF) is an election available to U.S. shareholders of a foreign corporation classified as a passive foreign investment company (PFIC) for federal income tax purposes.

A QEF election is often preferable to U.S. shareholders of a PFIC because it avoids the punitive excess distribution rules under Section 1291.

Under Section 1293(a), the QEF election allows the U.S. shareholder to include in income their pro rata share of the PFIC’s ordinary income and net capital gain income for the period.1 This income inclusion occurs even when the PFIC has not distributed dividends to the shareholder.

Under IRC Section 1295(b)(1), a taxpayer may make an election under this subsection with respect to any PFIC for any taxable year of the taxpayer. Such an election, once made with respect to any company, shall apply to all subsequent tax years of the taxpayer concerning such company unless revoked by the taxpayer with the consent of the Secretary.2

A U.S. person with a PFIC investment must generally file Form 8621 (Information Return by a Shareholder of a PFIC or QEF) with their annual U.S. tax return. The shareholder makes the QEF election in Part III of Form 8621.

In order to make the QEF election, the shareholder needs the following information about the PFIC:

- Name and address of foreign corporation

- Description of class of shares held by the shareholder

- Date shares were acquired (if applicable)

- Number of shares held at the end of the year

- Value of the shares held at the end of the year

- Pro rata share of ordinary earnings of the PFIC

- Pro rata share of net capital gain of the PFIC

Example QEF Election for a PFIC

On January 1, 2023, John Doe invested $500,000 cash in Fund ABC Ltd, a limited company (Ltd) formed in the Cayman Islands, which invests primarily in common stocks and corporate bonds.

The hedge fund has approximately $25,000,000 of net assets, so John’s $500,000 investment gives him a 2.0% interest in the fund’s net income.

For the 2023 calendar year, the hedge fund earned $1,625,000 of investment income and incurred $350,000 of operating expenses, which resulted in a net income of $1,275,000 for Fund ABC Ltd.

John received a PFIC statement from the fund, which reported the following information:

- Total Fund Net Income: $1,275,000

- Total Fund Net Ordinary Income: $255,000

- Total Fund Net Capital Gain: $1,020,000

- Total Dividends to Shareholders: NONE

John’s allocable share of the PFIC income is as follows:

- Allocable Total Income: $25,500

- Allocable Net Ordinary Income: $5,100

- Allocable Net Capital Gain: $20,400

- Dividend Distributions: NONE

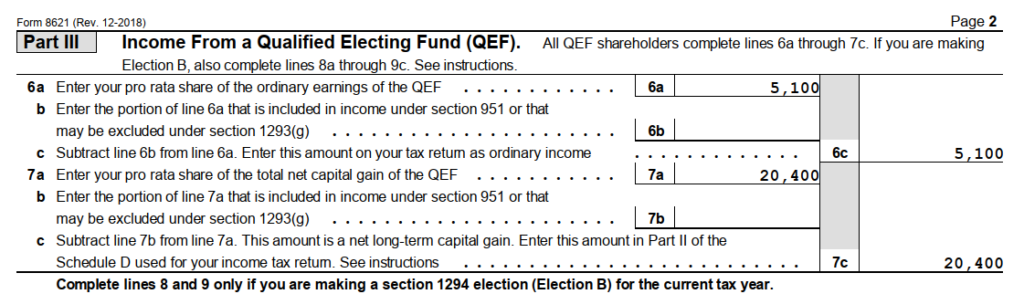

John wants to make a QEF election on Form 8621 with his Form 1040 for the 2023 tax year. John completes Part III by reporting his allocation of ordinary income for $5,100 and a net capital gain of $20,400.

The ordinary income of $5,100 flows to Schedule 1 (Additional Income & Adjustments), and the net capital gain of $20,400 flows to Schedule D (Capital Gains & Losses).

Sample Form 8621 Tutorials for QEF and MTM Elections

Check here for a video tutorial on how to prepare Form 8621 for a QEF election for a PFIC.

Check here for a video tutorial on how to prepare Form 8621 with a mark to market election for a PFIC.

Additional Information

Taxpayers seeking more information on PFICs can review the IRS Form 8621 instructions on the IRS website.