A partnership liability is a recourse debt to the extent a partner or related person bears the economic risk of loss for the liability.1 A partner bears the economic risk of loss if, upon the liquidation of the partnership, the partner or related party would be obligated to pay the creditor or contribute additional capital to the partnership to satisfy the debt.2

A partnership liability that is otherwise a nonrecourse debt may become a recourse liability if it meets one of the following circumstances.

- The partner is the lender (i.e., the partner loaned money to the partnership).

- The partner is related to the creditor; or

- The partner personally guarantees the debt.

Example Recourse Liability for Personal Guarantee

Partnership B, a Delaware limited liability company (LLC), has two members, John Smith and Jane Doe, who each own 50% of the LLC. The partnership operates a lawn care business in Orlando, FL. The company needed a new truck and trailer to transport their equipment between job sites.

The LLC purchased a new Ford F-250 for $50,000. The LLC put down $3,000 of cash and financed the remaining $47,000. The note agreement was between the bank (creditor) and the LLC (debtor). However, the bank also required John Smith to sign as a personal guarantor.

If the LLC defaults on the note and the bank repossesses the truck for resale, John is liable for any remaining unpaid balance.

Example Recourse Liability for Obligation to Make Payment

Partnership A, a Delaware limited liability company (LLC), has two members, John Smith and Jane Doe, who each own 50% of the LLC. On June 30, 2023, they decided to cease business operations and close the LLC.

As of June 30, 2023, the LLC’s assets comprised $5,000 of cash and had outstanding liabilities of $20,000. The LLC used its $5,000 cash to pay a portion of the $20,000 debt but still owed an additional $15,000 to the creditor.

Under the terms of the LLC operating agreement, the partners are obligated to make a capital contribution in proportion to their ownership interests to pay any unpaid partnership liabilities. Because of this obligation, the $20,000 of debt is recourse debt.

IRS Form 1065 Reporting

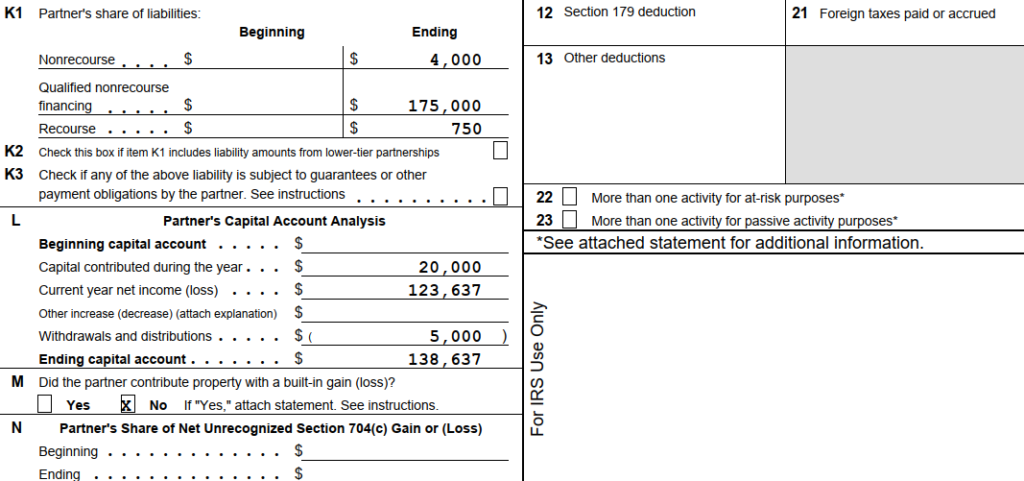

A partnership is required to separately state its nonrecourse liabilities, recourse liabilities, and qualified nonrecourse financing on Schedule K-1 (Form 1065). Each partner uses this information to calculate their basis under Section 704(d) and their at-risk basis limitations under Section 465.

The sample Schedule K-1 below shows the various allocations for this particular partner in Item K1 (Partner’s Share of Liabilities).

Other Information

Taxpayers can find more information on partnership liabilities and tax rules in IRS Publication 541 (Partnerships).