Concerning partnership taxation for U.S. federal tax purposes, four rules may disallow a partner’s ability to deduct their allocable share of partnership losses. Those four areas are:

- The partner’s adjusted tax basis in the partnership interest

- The partner’s “at-risk” basis

- The passive activity loss (PAL) rules

- The excess business loss limitations

Qualified nonrecourse financing connected with the purchase of real property is especially significant with respect to the “at risk” basis limitations.

Generally, a partner is only “at risk” with respect to their allocation of recourse debts and is NOT “at risk” with respect to their allocation of nonrecourse debts.

However, under IRC Section 465(b)(6)(A), a taxpayer shall be considered “at risk” with respect to the taxpayer’s share of any qualified nonrecourse financing that is secured by real property.1

Under IRC Section 465(b)(6)(B), the term qualified nonrecourse financing means any financing:

- Which is borrowed by the taxpayer with respect to the activity of holding real property,

- Which is borrowed by the taxpayer from a qualified person or represents a loan from any Federal, State, or local government or instrumentality thereof, or is guaranteed by any Federal, State, or local government,

- Except to the extent provided in regulations, with respect to which no person is personally liable for repayment, and

- Which is not convertible debt.

Example of Qualified Nonrecourse Liability for Real Estate Fund

Partnership Z, a Wyoming limited liability company (LLC), has two members, John Smith and Jane Doe, who each own 50% of the LLC. John and Jane formed the LLC to purchase a residential home to use as a rental property.

The LLC purchased a single-family home in Florida for $250,000, putting up $75,000 cash and financing the remaining $175,000 from a national bank. The mortgage is a 15-year note with a fixed interest rate of 6%. Under the mortgage terms, no LLC member or related party is personally liable for the mortgage debt.

Under these terms, the debt used to purchase the real property is qualified nonrecourse financing. The partners in the LLC can use their allocation of these liabilities in calculating their “at risk” basis.

IRS Form 1065 Reporting

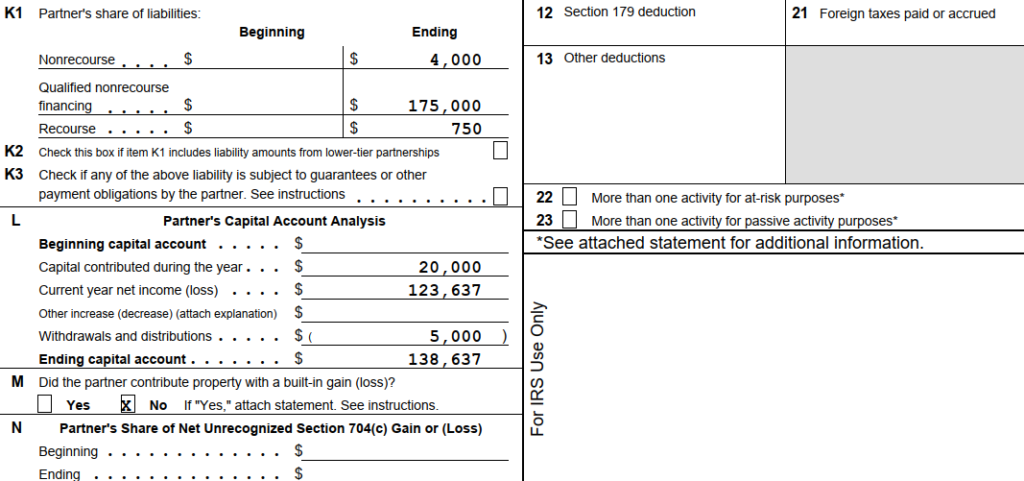

A partnership is required to separately state its nonrecourse liabilities, recourse liabilities, and qualified nonrecourse financing on Schedule K-1 (Form 1065). Each partner uses this information to calculate their basis under Section 704(d) and their at-risk basis limitations under Section 465.

The sample Schedule K-1 below shows the various allocations for this particular partner in Item K1 (Partner’s Share of Liabilities).

Other Information

Taxpayers can find more information on partnership liabilities and tax rules in IRS Publication 541 (Partnerships).