A company’s Other Comprehensive Income (OCI) account represents items of income and expense that are excluded from a company’s income statement and are instead reported on the company’s balance in the equity section.

Most of the items that comprise OCI are unrealized gains and losses. Common items include:

- Unrealized gains and losses on available-for-sale securities and investments

- Foreign currency translation adjustments

- Unrealized gains and losses on derivative contracts accounted for as hedges

- Costs related to a company’s pension plans, such as a defined benefit post-retirement plan

In general, there are slightly different standards on what items are included and excluded from OCI under U.S. Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). A company may also have different internal reporting standards for what income & expense items are included in OCI.

Example Calculation

Company A, a Delaware corporation, has an income statement that shows net income of $100,000 for the 2023 fiscal year. The corporation invested $50,000 into the purchase of stock in a publicly traded company, which has since increased in value by $5,000.

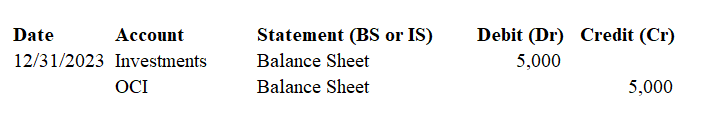

The $5,000 is an unrealized gain on available-for-sale securities. The corporation would not record a $5,000 increase to net income for the unrealized gains and losses. So, the $100,000 remains and it does not increase to $105,000. Instead, the corporation records an adjusting journal entry to increase the value of the investment asset (balance sheet account) and the amount of OCI (balance sheet account).

Notice how the company does not record a credit entry for unrealized gains going to the income statement. This AJE is only a balance sheet entry.