A hedge fund uses this fund structure to pool investor capital and invest those funds into various investments. The structure requires a minimum of two entities: a master fund and a feeder fund.

The master fund is the legal entity that owns the investments, which are selected by the hedge fund manager. The feeder funds receive capital from third-party investors and then invest 100% of those proceeds into the master fund.

The master fund is typically formed in a tax-free jurisdiction. The jurisdiction also has reliable and reasonable regulatory oversight, provides access to reliable banking & capital markets, and have professional service providers available to assist the hedge funds (e.g., lawyers, accountants, audit firms, fund administrators, etc.).

The Cayman Islands is the most popular jurisdiction for hedge fund formations. The Cayman Islands Monetary Authority (CIMA) is responsible for regulating the investment fund sector. Other popular jurisdictions include BVI, Bermuda, Bahamas, Guernsey, Jersey, Luxembourg, Mauritius, and Singapore.

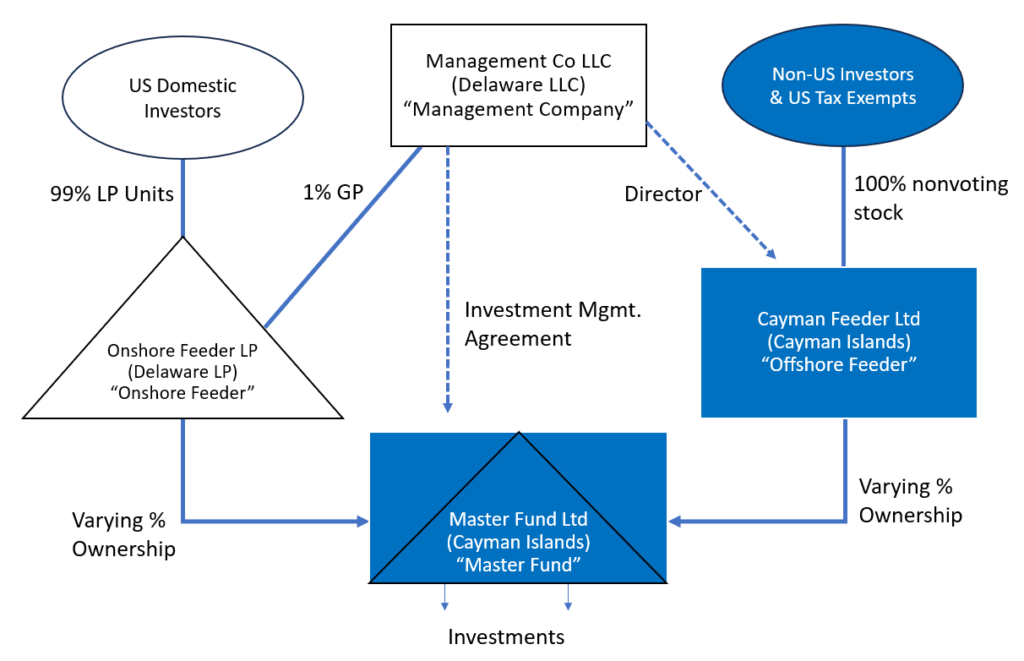

Below is a sample structure chart for a simple master-feeder fund structure. Below the structure chart are some additional notes explaining the structure.

A typical structure consists of the following attributes:

- The hedge fund manager forms the master fund, a Cayman Islands corporation. The manager forms the foreign feeder fund, a Cayman Islands corporation, and the domestic feeder fund, a Delaware limited partnership (LP).

- Feeder one is an “Offshore Fund” working as the foreign feeder in the Cayman Islands. This feeder pools capital from non-U.S. investors and U.S. tax-exempt investors. For U.S. federal tax purposes, the feeder is a foreign corporation. The offshore feeder is generally exempt from any U.S. tax filings; however, it may choose to file a protective Form 1120-F (US Income Tax Return of Foreign Corporation) tax return.

- Feeder two is an “Onshore” domestic feeder in Delaware. This feeder pools capital from U.S. tax-resident investors. For federal tax purposes, the onshore feeder is a partnership. The hedge fund manager holds the general partner (GP) units, while the third-party investors hold limited partner (LP) units in the onshore feeder. The onshore feeder must file an annual Form 1065 (US Return of Partnership Income) and provide a Schedule K-1 (Form 1065) to each investor.

- The master fund is, by default, a corporation for U.S. federal tax purposes. However, it files a Form 8832 (Entity Classification Election) to elect partnership tax treatment. The master fund files an annual Form 1065 each year and prepares two Schedule K-1s. The master fund provides a separate K-1 to the onshore and offshore feeder funds.

- The hedge fund manager enters into an investment management agreement with the master fund to manage the master fund’s investment portfolio. The master fund opens bank and brokerage accounts to invest the capital in various assets.

- The master fund’s income, expenses, gains, losses, and other items are allocated between the offshore and onshore feeders based on each feeder’s capital commitments. The amounts are reflected on the Schedule K-1s.

- The funds must also comply with annual filing requirements under the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS).