Deferred revenues are advance payments made by a customer to a company for services or products that have yet to be provided. The company receiving the advance payments records the unearned revenue as a liability on the company’s balance sheet, rather than recording any payments on the income statement.

Example Deferred Revenue

Company A, a Delaware corporation, provides marketing consulting services for customers throughout the United States. On December 15, 2023, the company signed a new client, who sent Company A an advanced payment of $50,000 for the services that will be provided under the contract. Company A did not start work on the project until January 5, 2024.

When Company A prepares its 2023 financial statements under U.S. Generally Accepted Accounting Principles (GAAP), it must account for the deferred revenue (i.e., unearned income) received from the customer.

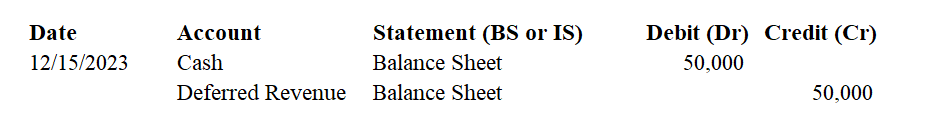

Rather than recording the $50,000 as revenue on the income statement, the corporation records it as deferred revenue on the balance sheet. The corporation makes the following entry when receiving the cash:

Notice how the receipt of cash is not recorded on the corporation’s income statement. Until the corporation performs any work on the project, they will leave the amounts in deferred revenue until it is earned.