A company estimates the uncollectible portion of its accounts receivables using an allowance for doubtful accounts. The allowance is necessary because it adjusts the net accounts receivable on the company’s balance sheet to more accurately reflect what the business will collect.

The allowance is a contra-asset account, which means its natural balance is a credit balance. A regular asset account has a natural debit balance.

How Does a Company Measure its Allowance?

Every company is unique. Therefore, each business generally sets its own standards for determining an appropriate allowance for doubtful accounts.

One of the most common metrics is the Days of Sales Outstanding (DSO). If a company has older uncollected accounts receivable, it becomes less likely that the company will ever actually collect on those accounts.

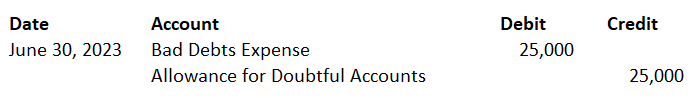

Once a company establishes an allowance, it can record an adjusting journal entry (AJE) on its financial statements.

Example AJE for Allowance for Doubtful Accounts

Company A is preparing its balance sheet for June 30, 2023. Company A’s gross outstanding accounts receivable balance was $250,000. Company A estimates that 10% ($25,000) of this balance may be uncollectible. Company A records the following AJE:

The net AR balance reported on the balance sheet is now $225,000 (250,000 – 25,000). The income statement now reflects a bad debts expense charge of $25,000.