When forming a limited liability company (LLC), entrepreneurs often look for ways to simplify legal structures and save on costs but not compromise the LLC’s legal protection, tax efficiency, and flexibility.

One business structure designed to address these needs is the Series LLC, a unique entity type that allows business owners to use one “master” LLC and create one or more “series” LLCs to separate assets & liabilities. Each series may have different LLC members, assets, operations, and investment objectives.

By separating these elements into a separate protected series, the operations and assets of one series are insulated from any liabilities or claims of the others. To better illustrate how the Series LLC structure operates, let’s first consider a traditional non-Series structure that uses a parent/subsidiary relationship with several LLCs.

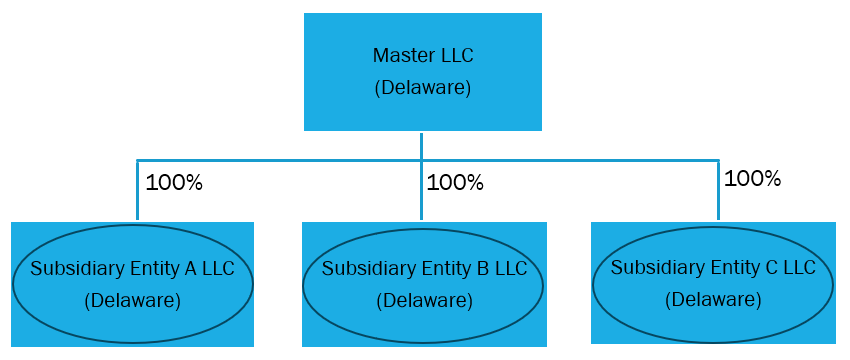

In the entity structure chart below, the Master LLC is created first by filing a Certificate of Formation with Delaware and paying the entity formation fees. Next, the Master LLC files a Certificate of Formation for each subsidiary LLC, and the master will own 100% of the LLC membership units.

Each subsidiary LLC conducts its business operations, has separate bank accounts, assets, and other liabilities, and offers liability protection between each subsidiary.

What are the annual filing obligations and fees for the above structure?

- Each standalone LLC must file an Annual Report with Delaware and pay the $300 filing fee (4 LLCs times $300 equals $1,200 in annual fees).

- Each standalone LLC must pay for its own registered agent (RA) fees. Most RA fees are $50 per year (4 LLCs times $50 equals $200 in RA fees).

- By default, the three subsidiary LLCs are disregarded entities for federal tax purposes, so the Master LLC consolidates the activities of the subsidiaries with the Master LLC’s tax filing. The tax return filed for the Master LLC will depend upon its tax classification (e.g., corporation, S corporation, or partnership).

- Note how the fee structure can be quite expensive when a structure continues to add additional subsidiary LLCs. The total filing fees and RA fees are $1,400 per year.

Consider a similar structure using a Series LLC instead.

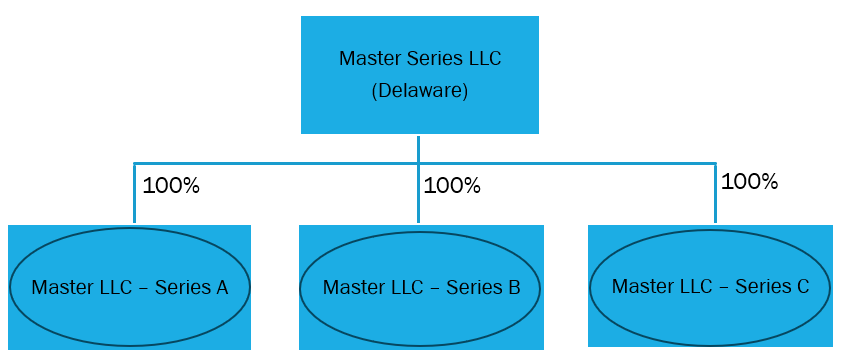

In the entity structure chart below, the Master Series LLC is created first by filing a Certificate of Formation with Delaware and paying the entity formation fees.

The Certificate of Formation should include a provision that the LLC has or may establish one or more designated series under Section 18-215 of the Delaware Limited Liability Company Act.

The certificate should also include a limited liability provision, which provides that the liabilities of one series can only be satisfied using the assets of the same series, and those debts are not enforceable against the Master LLC or any other series.

The Master LLC prepares and executes its LLC operating agreement. The LLC managers can amend the LLC operating agreement to create three separate Series (i.e., Series A, B, and C).

Highlights of the Series LLC.

- There is no requirement that the Master LLC file any notification with Delaware that it has created a separate Series.

- The Master LLC can, if it chooses, file a Series Registration statement with Delaware for one or more of the Series created. By doing so, the Series will be searchable on the Delaware Division of Corporations website.

- Each Series can have separate assets, liabilities, operations, and ownership.

What are the annual filing obligations and fees for the Series LLC structure?

- The Master LLC must file an annual report with Delaware and pay the $300 filing fee. An additional fee for each Series is not required unless the LLC separately files a series registration statement.

- The Master LLC must pay for its registered agent (RA) fees. Most RA fees are $50 per year. Each Series can rely on the Master LLC for RA services, so additional RA fees are not required.

- By default, the three subsidiary LLCs are disregarded entities for federal tax purposes, so the Master LLC consolidates the activities of the subsidiaries with its own tax filing. The tax return filed for the Master LLC will depend upon its tax classification (e.g., corporation, S corporation, or partnership).

- Each series can admit one or more LLC members, which may differ from the other Series. If the Master LLC creates different ownership structures within each series, each series can have a different tax treatment.

- Note how the fee structure can be quite expensive when a structure continues to add additional subsidiary LLCs. The total filing fees and RA fees are $1,400 per year.

Which States Allow Series LLCs?

Not all states allow Series LLCs. As of 2024, a Series LLC is recognized in 22 states, Washington D.C., and Puerto Rico. Delaware was the first state to recognize Series LLCs in 1996 and remains one of the most popular jurisdictions to open a Series LLC.

The Series LLC model was inspired by segregated account companies (SAC), which have been available in many offshore jurisdictions for decades, such as those in Bermuda, Bahamas, and the Cayman Islands. Bermuda popularized the SAC for use in the captive insurance space, particularly with ‘rent-a-captives’ where one insurance company rents its capital and surplus to several policyholders by setting up a separate segregated account for each.

While some states recognize Series LLCs, others do not yet support or acknowledge their status. Therefore, business owners with assets or operations in multiple states should consider each state’s stance before using a Series LLC. Using a Series LLC across state lines may not provide the best asset protection for the LLC.

Why a Series LLC Can Save You Money

Reduced Filing Fees: As highlighted above, using the Series LLC structure rather than creating multiple subsidiary LLCs will save annual filing and registered agent fees. If a Master LLC has dozens of individual Series, the annual savings can be substantial.

Centralized Management and Record-Keeping: Because each series is part of the Master LLC, maintaining a single set of administrative records is often more straightforward and cost-effective. Each series can leverage the LLC operating agreement of the Master LLC.

Flexibility in Adding New Ventures: By using a Series LLC, the manager can easily create a new series by simply forming one under the terms of the operating agreement. The operating agreement should maintain an Appendix that lists each series, date of formation, underlying assets, the members & managers of the series, and separate business purposes or objectives.

Streamlined Tax Reporting: For U.S. federal income tax purposes, each series within a series LLC can be treated as a separate taxable entity and largely follows the “check-the-box” regulations. Therefore, each series is a partnership, disregarded entity, or corporation.

For example, assume John and Jane form a Master LLC, and each owns 50% of the LLC membership units. The Master LLC creates a series, “Series A,” with separate assets and admits Adam and Emily as members of that series only. The Master LLC is a partnership entity filing Form 1065 (US Return of Partnership Income) with John & Jane as partners. The Series A files a second Form 1065 (US Return of Partnership Income) with Adam and Emily as members. Note how Series A will need its employer identification number (EIN), which is distinct from the Master LLC.

In most cases, each series is owned 100% by the “master” LLC, so each series is disregarded for federal tax purposes. A separate series can file a Form 8832 (Entity Classification Election) to elect to be treated as a corporation separate from its owner.

Example Use Cases for a Series LLC

The series LLC can be quite beneficial for many businesses.

Real Estate Investors: Real estate investment funds often use Series LLCs to hold multiple properties, with each series owning one property. By isolating each property in its own series, the assets, liabilities, revenue, and expenses for each property are also contained within their own series.

Private Equity & Hedge Funds: Investment funds often use series LLCs to segregate investment assets for liability protection. Because each series can also have a different LLC membership, using a separate series helps track which investors want to invest in each asset or group of assets.

Final Thoughts

While Series LLCs can offer flexibility and cost savings, they can be complex and may not be the best option for your situation. The lack of universal recognition across all states can complicate matters if you plan to operate your LLC in multiple jurisdictions.

We recommend you consult with your legal & tax advisors to understand the implications of using a Series LLC and whether it suits your business needs.